StockX: Disrupting Online Marketplaces with Transparency, Trust, and Data-Driven Success

Deconstructing StockX and reflecting on my experience working at marketplace technology companies

(cool comic image generated from within substack. YAY for AI image generation)

What is StockX? (and why am I interested in analyzing it?)

StockX is a revolutionary online marketplace that specializes in the trading of high-end, limited-edition products like sneakers, streetwear, and other sought-after items. By addressing the challenge of trust in peer-to-peer transactions, StockX has become a go-to platform for both collectors and casual buyers alike.

As a product manager, I have a passion for exploring marketplaces. Throughout my career, I've been drawn to working at marketplace and commerce platforms, such as Drops on Instagram, StyleSeat, eBay, and Yelp Restaurants. This has allowed me to gain insights into a variety of problems faced by these businesses. Analyzing the success and growth strategies of companies like StockX is both exciting and an invaluable learning experience.

What makes StockX a marketplace?

A marketplace is essentially a space where sellers and buyers convene to exchange goods or services. In the context of StockX, this "space" is an online platform that connects people selling highly desirable, limited-edition items with those looking to purchase them. StockX expertly facilitates these digital interactions between buyers and sellers.

💡 StockX is sort of a 3-sided marketplace, with key players including sellers, buyers, and the StockX team responsible for verification and other tasks. Although trading could take place directly between sellers and buyers, StockX adds value through its 'verification' process, which guarantees authenticity and consumer satisfaction.

What’s the supply-side and demand-side story?

The supply-side of a marketplace refers to the sellers and the types of goods available for purchase. Since its founding in 2016, StockX has grown significantly, claiming to have over 1.5 million lifetime sellers as of 2022.

💡 1.5 million lifetime sellers is an impressive statistic. Assuming 20% of them drive 80% of the GMV (a common trend on most platforms), that would equate to around 300,000 sellers – a clear indication of a well-scaled platform.

The demand-side encompasses the consumers making purchases. As of 2022, StockX reported 12 million lifetime buyers and 31.8 million total visits in March 2023. This remarkable growth is noteworthy for a platform that didn't exist six years prior.

This article delves into StockX's early growth strategies, addressing the classic chicken-and-egg problem(i.e. what comes first (and why) supply or demand?). Founder Josh Luber envisioned a platform that could serve as a "stock market for things," starting with sneakers.

Unique compelling value proposition:

A key factor in attracting both supply and demand was providing end-to-end transparent, data-driven, and verified trusted transactions in a market often perceived as rife with scammers. StockX has been delivering value to users since day one.

(Screenshot of the data available to buyers)

💡 Finding a unique hook that compels consumers to use a new platform can be incredibly challenging. StockX's ingenious approach of leveraging data (which eBay has accumulated for years!) and presenting it to users in a manner that aids their decision-making process likely played a significant role in generating buzz and attracting users to the platform.

Understanding Liquidity and StockX’s Success Factors

Liquidity in a marketplace context refers to how easily buyers and sellers can find each other.

Lenny's newsletter discusses the concept of "Fill Rate," which is an essential measure of a marketplace's health. It reflects how easily a buyer can find and purchase what they want.

Sarah Tavel states, "The marketplace that wins is the marketplace that figures out how to make their buyers and sellers meaningfully happier than any substitute. GMV alone is a vanity metric that can lead you down the wrong path if you chase it."

💡 My hypothesis is, StockX's most engaged consumers typically know what they want, so the platform's focus on helping users navigate the site or app and quickly find products is crucial. Unlike GOAT, which has a more aesthetically appealing design, StockX prioritizes functionality over appearance. This approach is reminiscent of Amazon's design principles.

For StockX, fill rate could involve examining various parts of the consumer funnel, such as: Search → Product Display Page → Dwell time on page/bounce rate/engagement on page → time to place a bid or buy → checkout success.

Drawing from my experience at eBay, there were entire teams dedicated to each part of the buyer funnel, running numerous experiments to optimize and identify the best ideas to help buyers make informed decisions. In my humble opinion, StockX's focus on providing a seamless user experience has played a significant role in its success.

(Screenshot of StockX product-display-page)

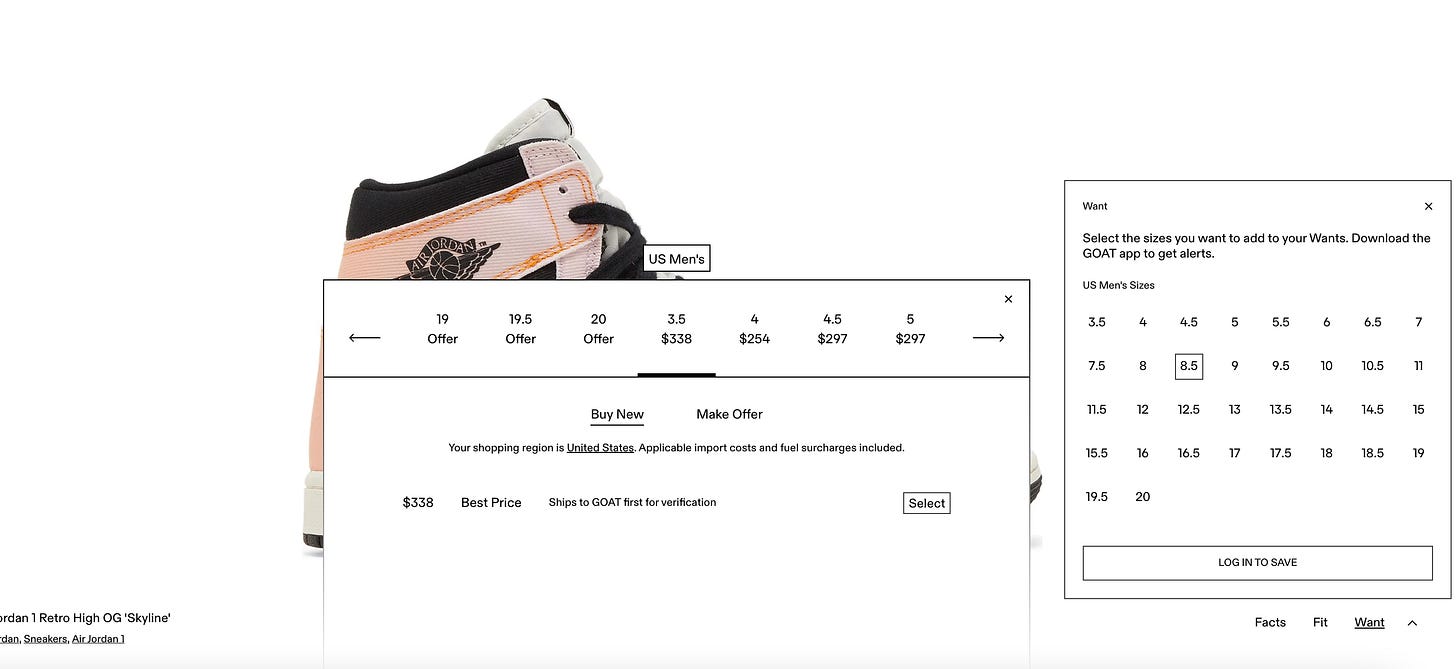

(Screenshot of GOAT.com’s product display page)

What makes StockX standout?

1. Consumer transparency: The founders quickly identified what mattered to consumers or sneakerheads and focused on addressing those needs. They recognized the issues of scammers, lack of transparency, and low trust in peer-to-peer networks and aimed to resolve them.

💡 To create the perfect consumer happiness moment, we need to address users' perceived problems and align them with their desires. StockX does this by tackling the perception of low trust with transparency and verification processes, enabling consumers to become proud owners of rare sneakers.

2. Ease of sale for sellers: StockX offers a pain-free experience for sellers when listing products. There's no need for photos or descriptions; sellers simply find the product and sign up to list it at a desired price. The power of the internet and data has revolutionized the way products are sold. This innovation has pushed other platforms, like eBay, to improve their own processes, driving competition and benefiting consumers.

💡 The evolution of seller tools is impressive. Developing effective seller tools that make lives easier and enable economic growth is highly motivating. With seller programs, dedicated customer support, APIs, and cross-selling tools, platforms can better serve their millions of sellers.

More generally it seems inefficient for every company to develop their own unique seller tools. Standardizing protocols could level the playing field and increase system efficiency across marketplaces. Maybe AGI’s will change that.

3: Trust in product quality through verification: In a low-trust industry, it's essential for platforms to emphasize verification and authenticity. This is likely a significant portion of StockX's operating expenses, especially when onboarding new sellers and products.

💡 In markets like Asia, where the volume of counterfeit products might be challenging to authenticate manually, platforms may need to reintroduce 'seller' personas and profiles, allowing only trusted sellers to operate in such markets.

Closing thoughts:

Here’s my quick take on where StockX plays relative to the main retailers using Nike as an example. Looking at this, there’s so much opportunity for creating circular economies of commerce to encourage reuse, minimize carbon footprint and encourage mending (vs sewing)! I’m excited for what the future of marketplaces and commerce holds!

There’s so much more to be deconstructed with marketing, branding, operations, risks, maybe in part 2 someday. Let me know what you think and what ideas may have stood out in my quick analysis of StockX!

Note: All thoughts and opinions shared here are my own.